Note: A Disbursement is the industry term for a payment of money from a fund.

If you file an insurance claim, there is an overwhelming chance that it will be paid via a mailed check. If you are in a situation where you need funds immediately, like if your home is damaged by fire and you need to stay at a hotel immediatly, the wait to receive a check is not a good experience. To provide the best experience for their customers, and innovate within the insurance industry, Farmer’s insurance partnered with Paymentus to create an instant disbursements solution.

My Role

As lead product designer, I managed the requirements gathering, discovery and design, as well as product management during the development of the application.

Goal

To create a tool that quickly and easily disburses digital funds to users who are typically in a state of crisis.

Requirements & Considerations

The application is required to be web-based. It must function on both mobile and desktop. The interface should be themeable as Farmer's Insurance subsidiaries will also utilize it. Additionally, an agent management system will be developed.

Requirements Gathering and Discovery

No identifiable examples of instant, digital disbursements currently exist in the insurance industry. Peer-to-peer fund transfer is increasingly common, and many solutions exist (paypal, venmo, cash app, zelle). Since these solutions are not business-to-consumer, additional legal and regulatory restrictions of the insurance industry must be considered in the final design.

The proposed solution must also be secure and trustworthy. The issue of personal identification must be considered within the functionality. Assignment of incorrect payees happens frequently in the peer-to-peer segment. For the business-to-consumer special attention must be paid to the disbursement of digital funds and the verification of personal identity to avoid incorrect payments. An in-depth method for identity verification will need to be integrated to ensure that the correct person receives the funds.

The discovery process included interviewing multiple insurance professionals to gather additional information on the current disbursement process, especially with regard to opportunity for improvement. Follow up review sessions were held for feedback on proposed solutions as the design was developed.

Creating the User Flow

- User files an insurance claim (via phone call).

- An agent/adjuster would create a disbursement in the admin application.

- User would receive an email or text with URL to the payment portal.

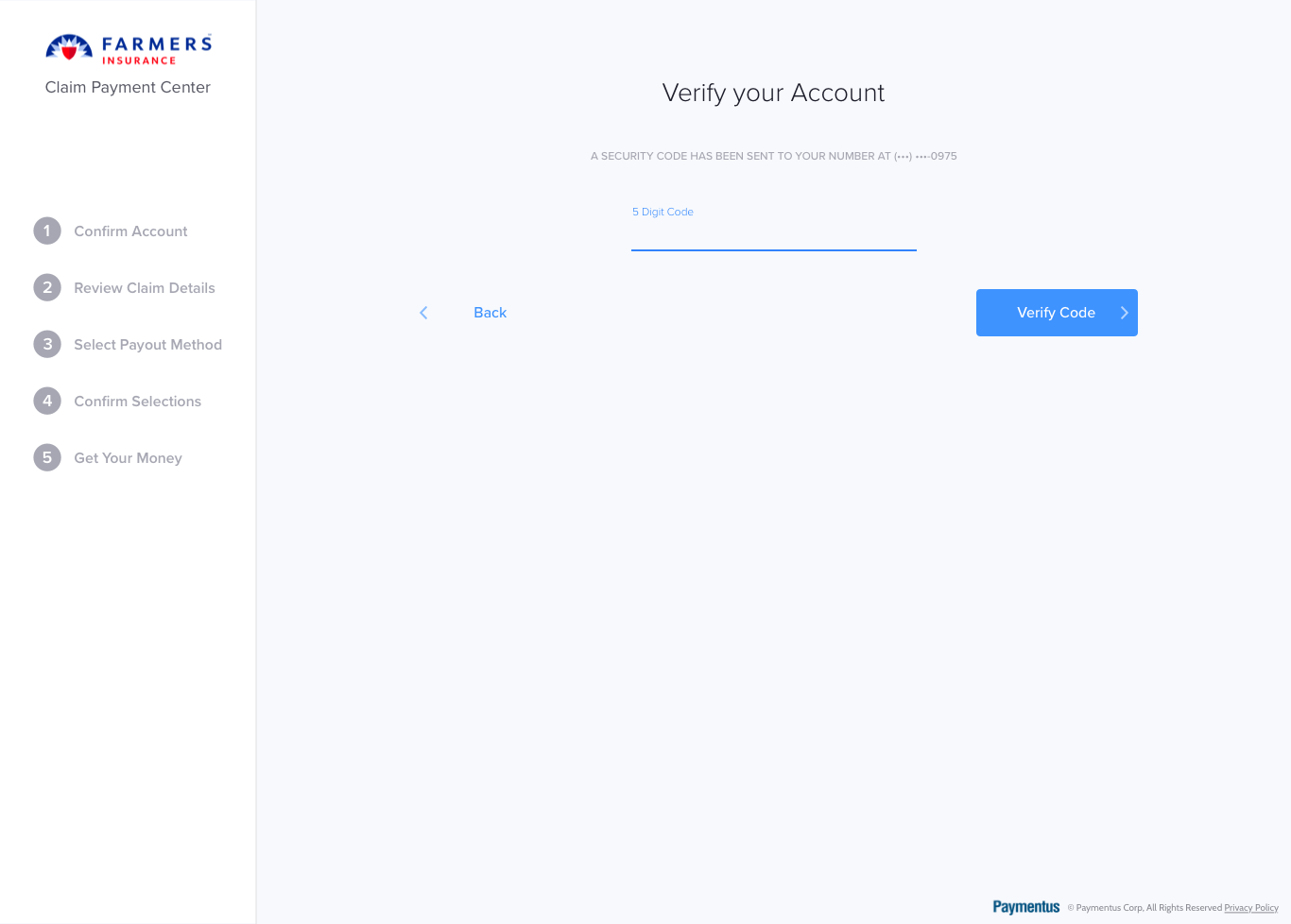

- User answers security question(s).

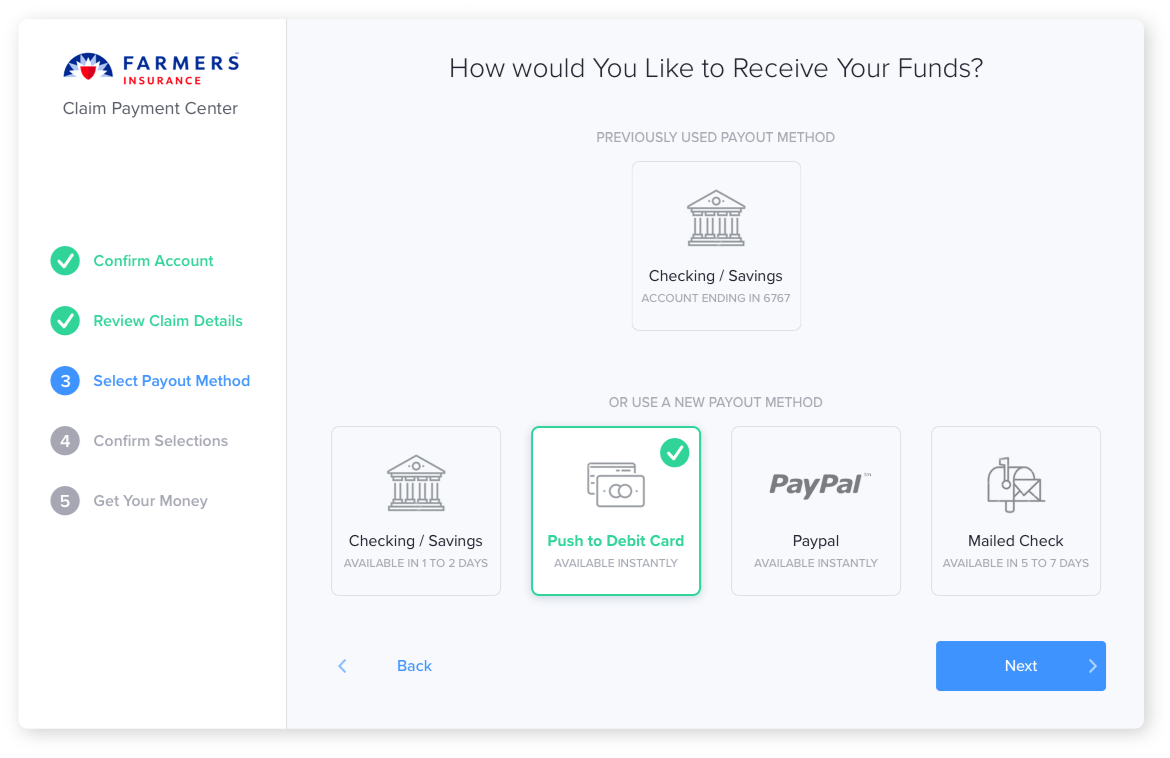

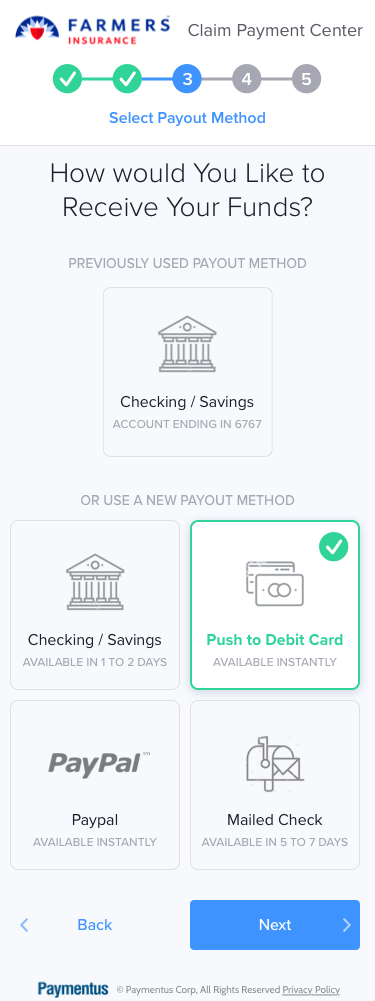

- User selects method to receive funds (paypal, push to debit, ACH).

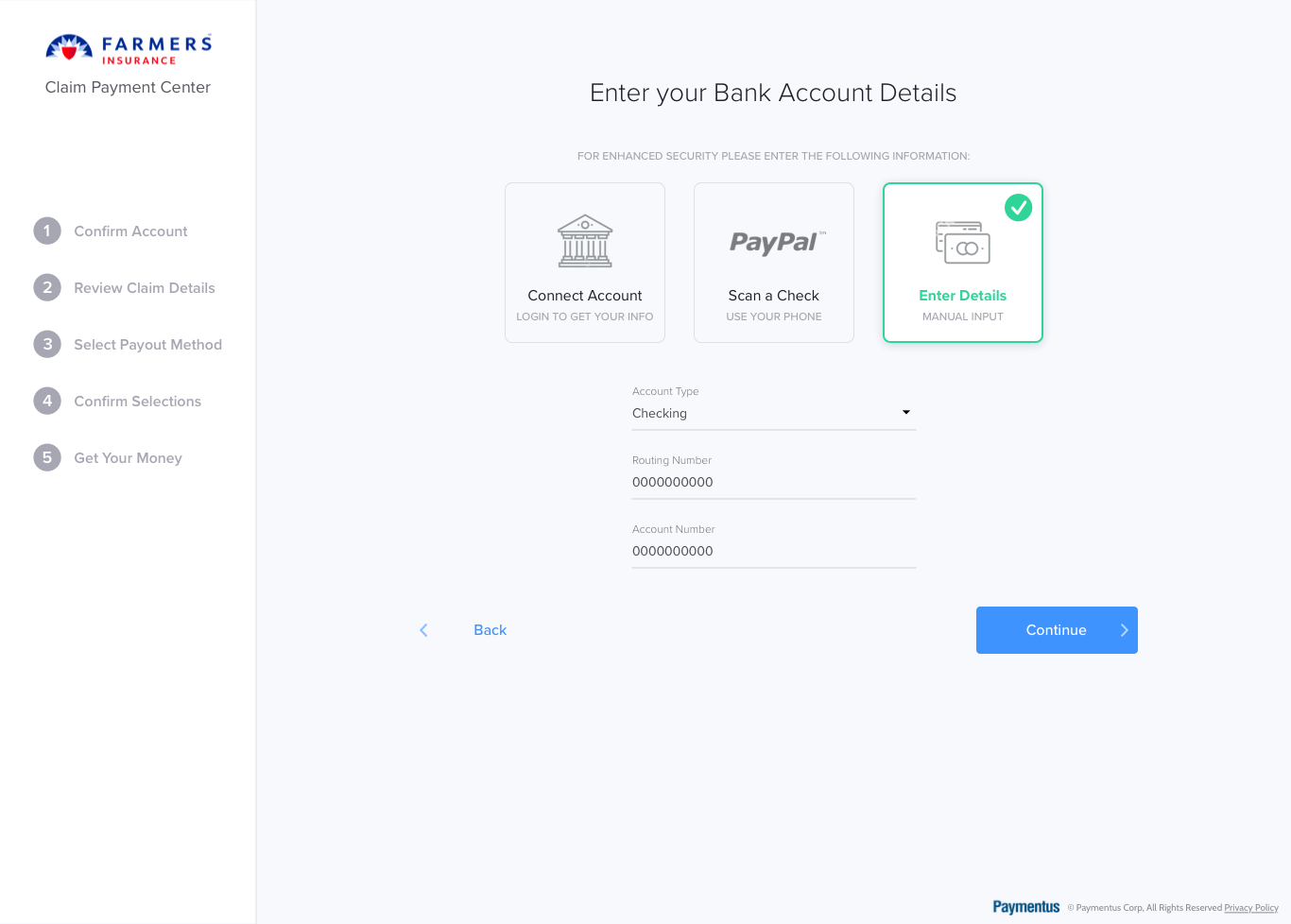

- User enters applicable account details.

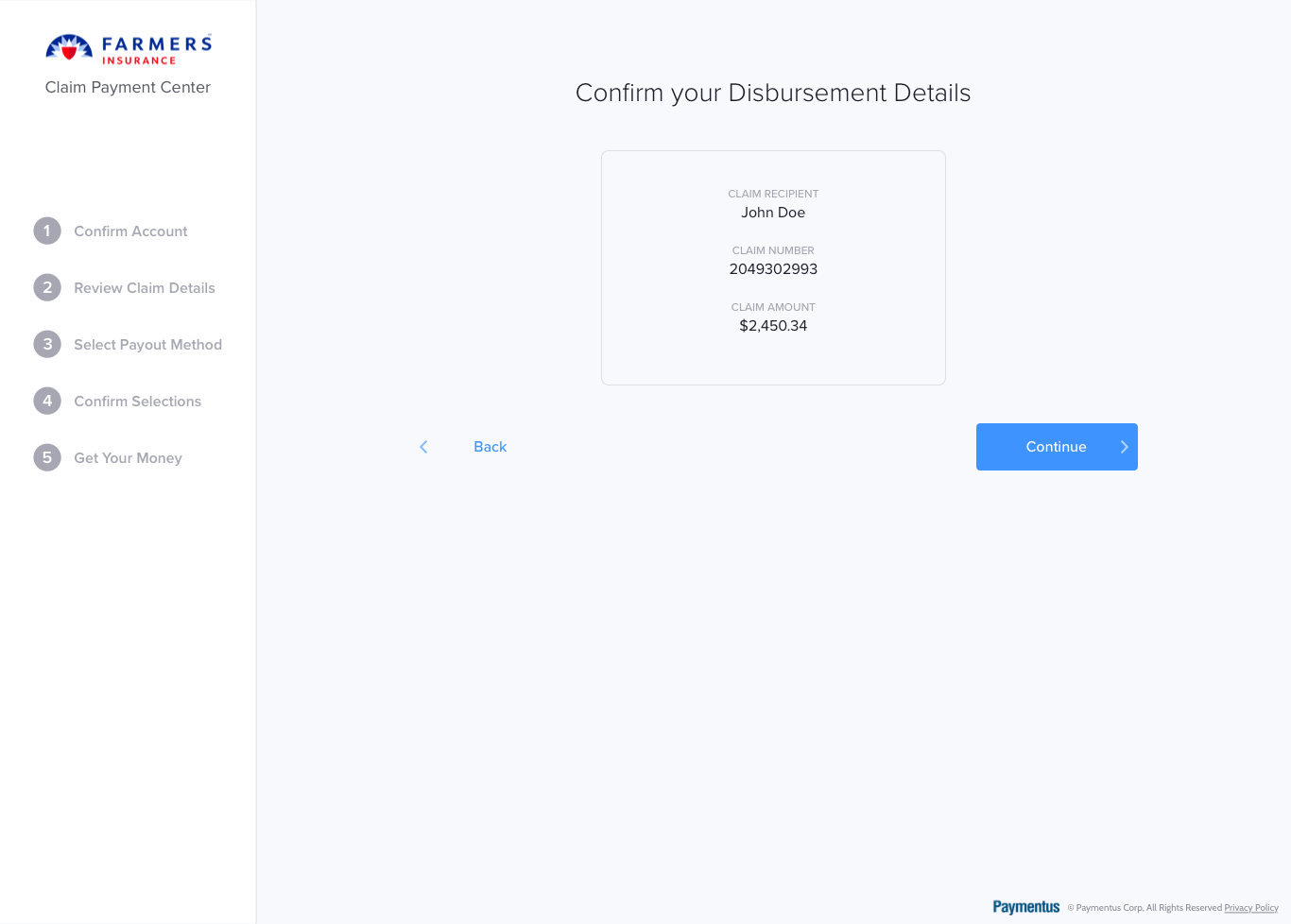

- User confirms information.

- User receives funds.

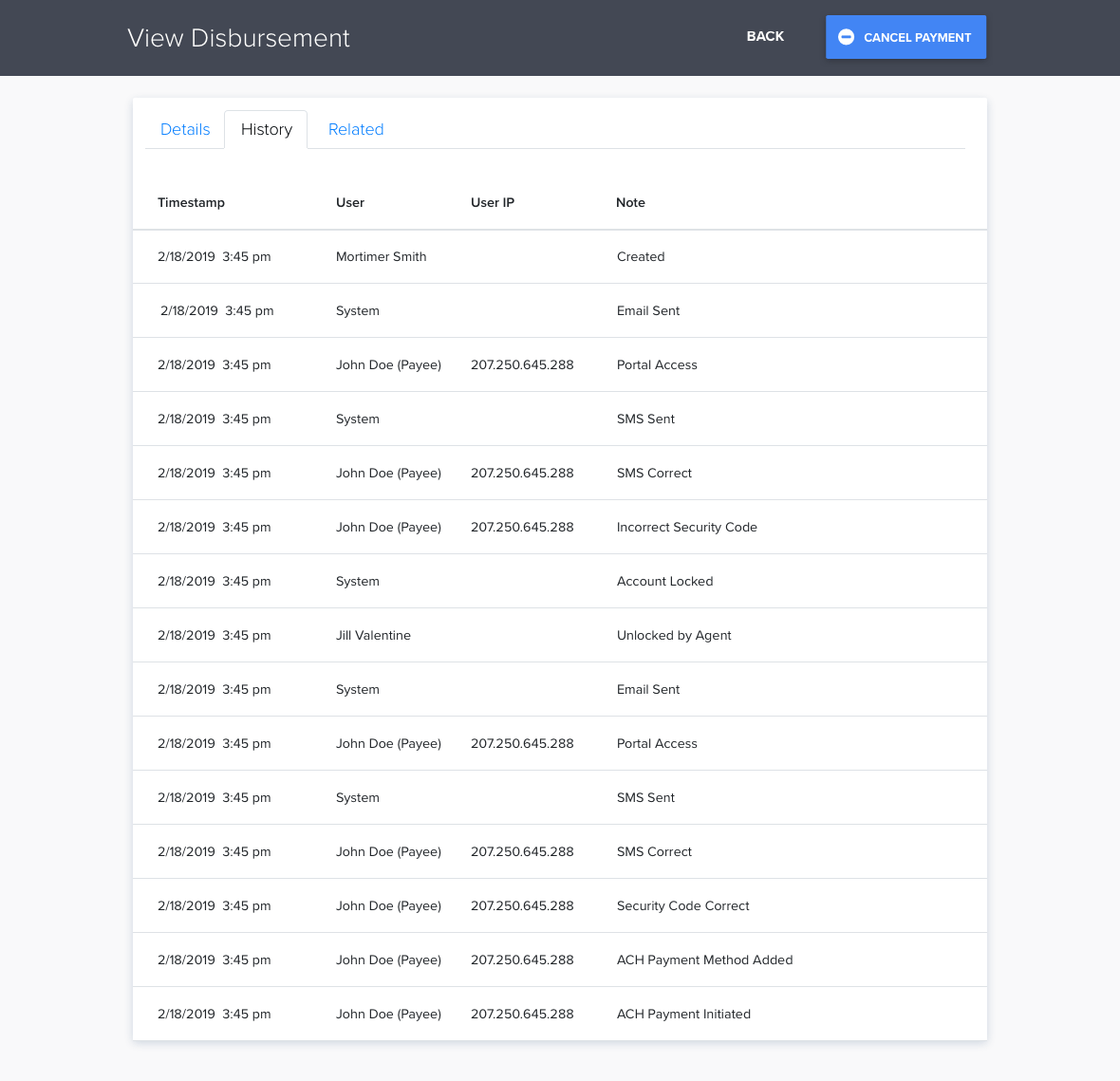

Lockout user flow

What happens if a user fails the security check?

User Portal Design (desktop)

Responsive Mobile

Discovery and user interviews confirmed that users would need to access disbursements on mobile. The purpose of the disbursements portal is to decrease the time from approved claim to receipt of funds. Since users could potentially be in situations where they are stranded or need immediate financial assistance, speed of payment is key. Emergency situations such as a house flooding or a totaled car require emergency level response. The mobile experience must be easy, fast & secure.

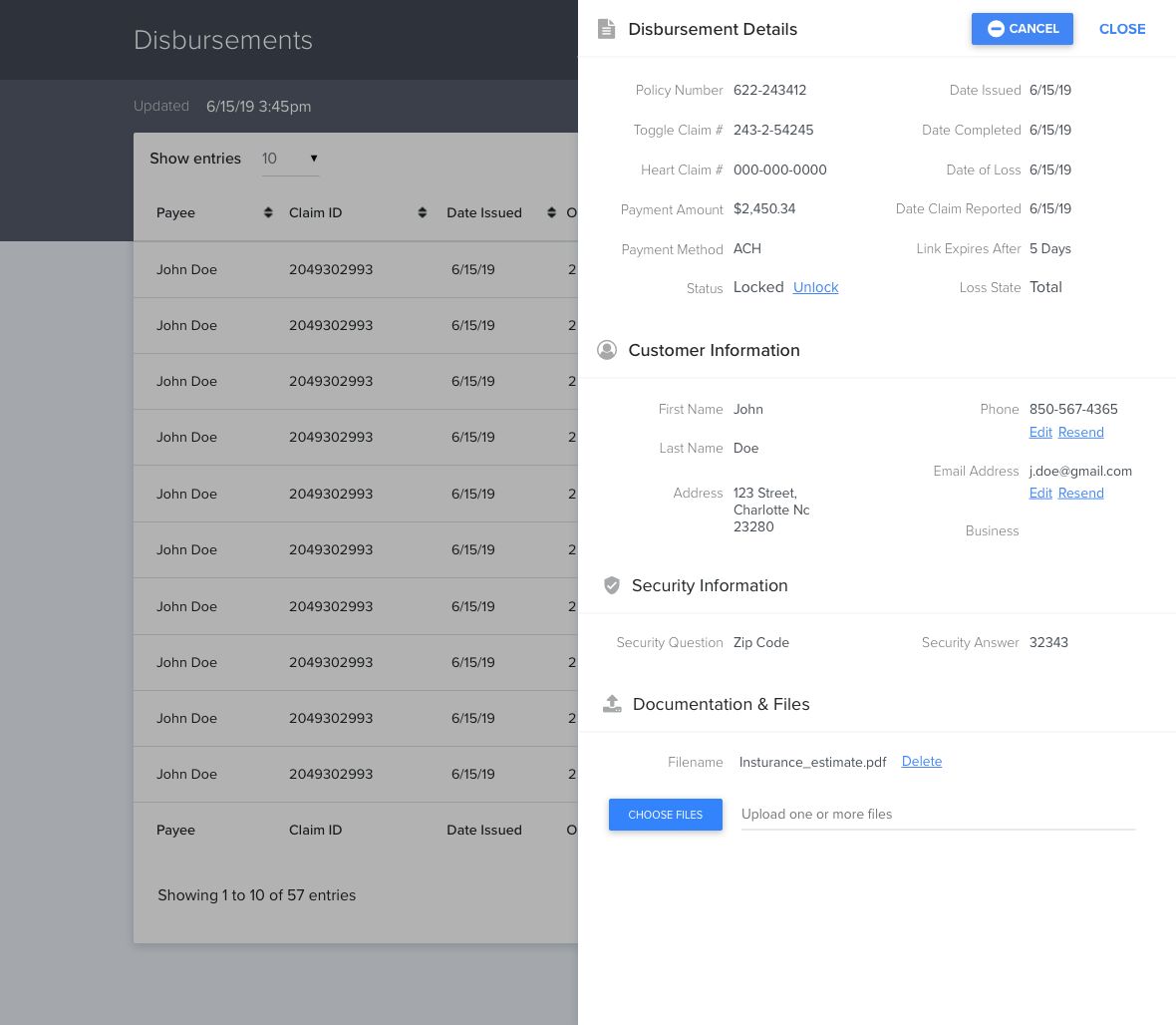

Admin Portal

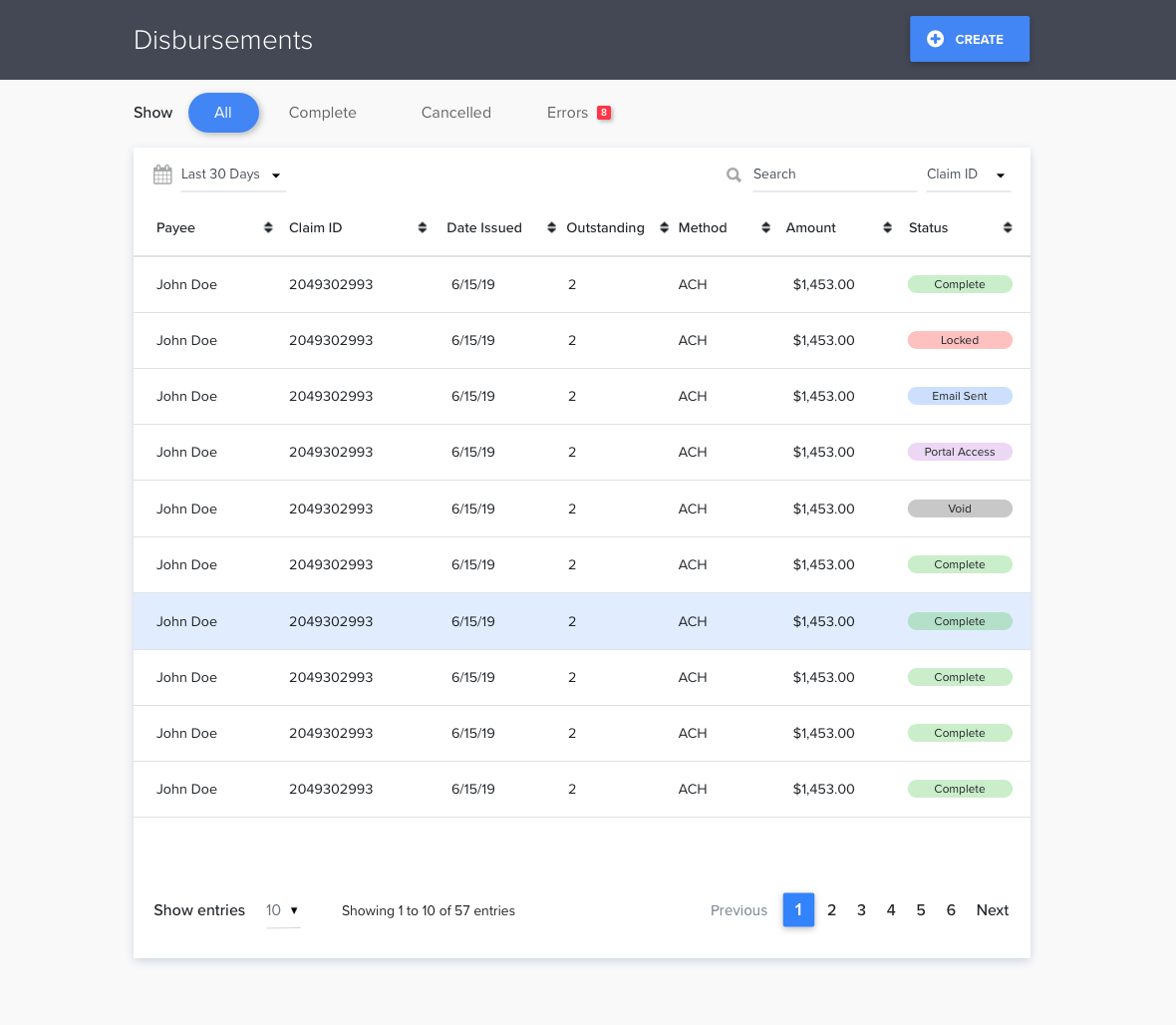

There was additional need for a robust Admin application. This would provide the claims adjuster tools to create, edit, & void disbursements. The Admin portal requires history and reporting capabilities for regulatory and compliance purposes. The status of disbursements should overtly display errors, should any support issues arise. The admin portal is also designed to be embedded in Farmer's internal management site.

Disbursements Admin Overview

Existing software allows insurance companies to create and manage claims, but the process typically concludes at point of payment. The new system would need to sit in between the claims management system and the check disbursement system. Also, a failsafe would need to be designed to immediately mail a paper check if digital funds were not claimed within a set timeframe. Regulations require that funds be disbursed within given timelines once claims are approved. Automatic user notification will also need to be integrated.